The Great Regression

All views are my own. This is not financial advice.

A few weeks ago it was announced that top Silicon Valley venture capital firm Andreesen Horowitz led an investment round in Yuga Labs, the company that created the massively successful NFT project Bored Ape Yacht Club.

Yuga Labs raised $450 million, putting the company's valuation at $4 billion. Yuga Labs needs the funding to build out their metaverse and further expand their NFT ecosystem.

Philosophical Dissonance

For those unaware, many NFT projects launch NFTs partially in an effort to raise money to build out the project. In some cases, it is essentially like crowdsourcing investment from your early believers. Some projects are transparent that this is exactly what they’re doing and in turn, treat their NFT holders like shareholders. In other projects, the creators are bluntly straightforward about this not being the case, that the NFT you are buying is just art and not equivalent to a financial investment.

There’s a fine line. If you are caught advertising your NFT launch as investment in a new company, secondary marketplaces will delist your NFT project as it looks like a security and they don’t want to come under fire from the SEC. Marketplaces don’t control the market on primary sales. A project can sell out by buyers going directly to a projects website and purchasing. Many buyers want to buy securities in the form of NFTs. As such, it is common for projects to pitch their NFT project as a security but dance around the issue by adding features to the project that add unnecessary value. For example, a project may talk about introducing a cryptocurrency token for buyers to speculate on the future value of the project. They allow the token to be utilized within the project's ecosystem, similar to a Chuck E Cheese token (that can be used within games etc the project creates), so that it has real world utility and is not just a means for financial speculation.

Some project founders seriously intend to built out a robust ecosystem (like Bored Ape Yacht Club), some say they will be building out a robust ecosystem to generate hype but ultimately don’t have the technical know-how to actually pull it off.

In the Bored Ape Yacht Club’s case, the line is blurry. The team has the know-how and resources to build something massive but what you are getting when you purchase an NFT from Yuga Labs has always been a little gray.

When you buy a Bored Ape Yacht Club NFT you get the intellectual property rights behind that specific NFT. This means you have the right to create a new derivative business if you choose with your NFT. This has been done multiple times.

For example, Andy Nguyen, a Bored Ape Yacht Club NFT holder, is launching his new restaurant “Bored & Hungry” April 9th, 2022 in Long Beach, California. He was able to leverage the IP he was granted by purchasing a Bored Ape Yacht Club NFT and is creating a business out of it. The Bored Ape Yacht Club’s umbrella company Yuga Labs, does not get any royalties or need to grant permissions. This has been at the heart of The Bored Ape Yacht Club’s ethos since the beginning.

The Bored Ape Yacht Club project was built by the people for the people. There has always been an “all in this together” mentality.

When it started, the Bored Ape Yacht Club was fringe, almost cyberpunk. The name in itself is embodied in sarcasm and designed to be a middle finger to the traditional financial system.

Whether people want to admit it or not, buying NFTs for many is an alternative financial investment vehicle to what is currently being offered in the traditional system. Many see this as a new, unregulated way to angel invest in their favorite projects.

The idea is, the project takes your money, then builds something massive and the price of your NFT goes up due to reciprocity from the project down the line. They can send airdrops and additional value to NFT holders and create fomo for the rest of the market, causing a supply shock if there are no sellers (only aspiring buyers).

This time around, Yuga Labs raised investment from Andreesen Horowitz who in turn got a significant equity stake in Yuga Labs. Andreesen Horowitz has invested in companies like Stripe, Airbnb, Twitter, Okta, Facebook… the list goes on.

Yuga Labs did not run their plans to raise investment by their community.

Should they have? Did the community just get their ownership diluted?

There’s so much gray area in this wild west ecosystem.

Regressing from Web 3.0 back to Web 2.0

Back in August of 2021, Yuga Labs raised $96 million in 1 hour from their community when they launched a subsequent NFT set called the “Mutant Ape Yacht Club”. See image below.

Sourcing investment for the next phase of the Yuga Labs ecosystem should have been presented to the NFT token holders just like they did every time in the past.

When Yuga Labs first sold the Mutant Ape Yacht Club NFTs, they never explicitly said to community members that they were investing in the project. But many felt that way. Yuga Labs took the money and reinvested it in the project, like any smart business. This is not wrong but since there’s so much gray area about what exactly buyers are buying, many buy with the expectation that by purchasing an NFT, and by the project using that money and becoming successful, the value of their NFT will go up as a result. As such, buyers often equate their purchases to being similar in dynamic to buying a stock or another investment vehicle.

Many in the community, whether Yuga Labs wants to admit it, feel financially invested in the project.

Raising this round of capital from traditional Silicon Valley venture firms like Andreesen marks a regression from a Web 3.0 company to a Web 2.0 company for Yuga Labs. They are contradicting the ethos and philosophy that they always looked to promote.

There is nothing wrong with Yuga Labs raising money from Andreesen or any other company for that matter. It’s a tried and true model that has been working to accelerate the growth of our most valued tech companies for years. The problem is that up until this point the Bored Ape Yacht Club has been built around being “for the people, by the people”. In building around that concept in this space, where decentralization is sought after and transparency is revered, the best way to raise money that would be in-line with their philosophy would be to source it from their community through a new NFT drop.

Yuga Labs originally may have been for the people, by the people. Now that there is real money involved, their plans seem to be changing. The goal appears to be, make as much money as possible and become the dominant player in NFTs.

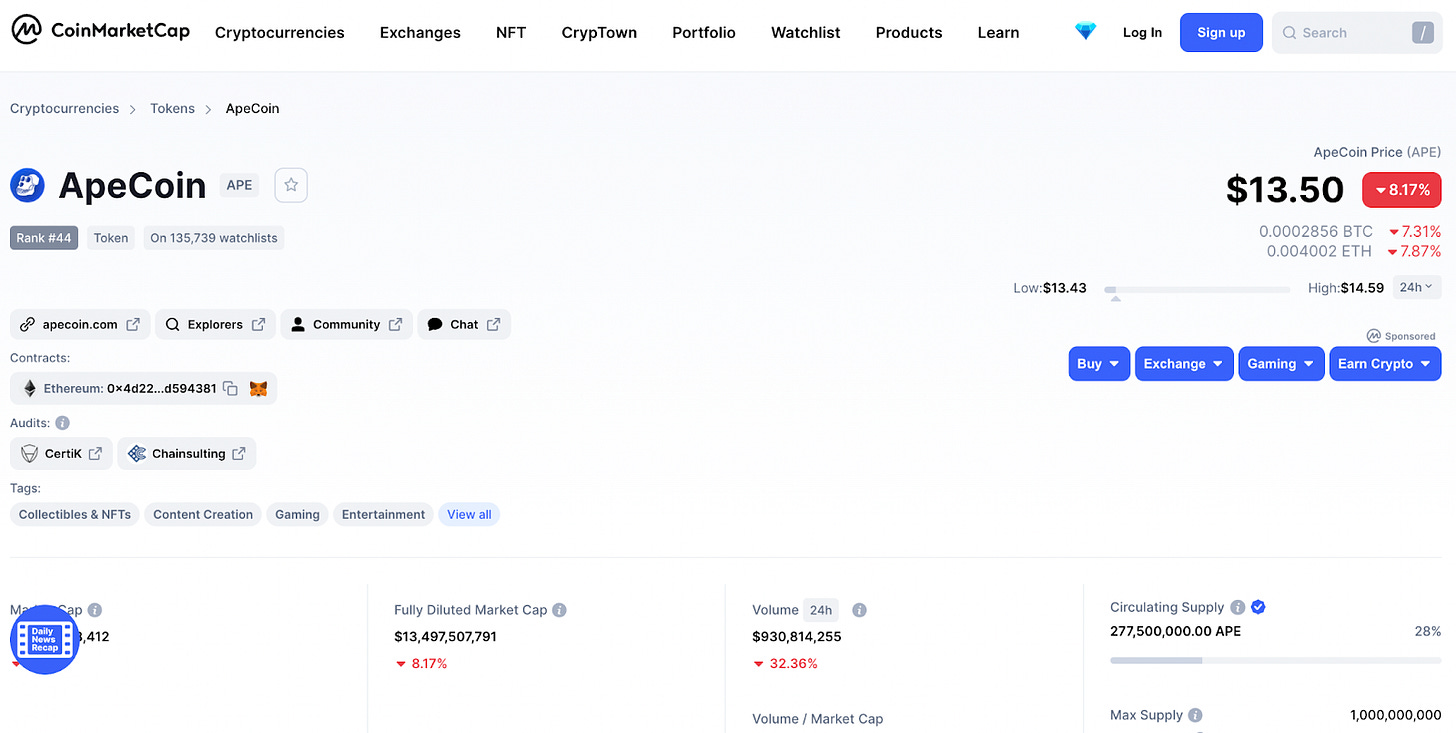

This investment announcement most likely was planned to coincide with the Yuga Labs ApeCoin launch. See below for the coin data on Coinmarketcap.

Many Bored Ape Yacht Club NFT holders were granted thousands of ApeCoin when it launched on March 17, 2022. Hundreds of people were given over $100,000 in ApeCoin as a result.

If Bored Ape NFT holders weren’t granted so much ApeCoin there most likely would have been an uproar over the investment from Andreesen Horowitz.

What’s the problem?

The ethos of Web 3.0 is supposed to be a “for the people movement”. This may be idealistic but it is what the community promotes. In this case, it seems to only be a concern when people are losing money. When people are making money, like original Bored Ape NFT holders, it seems to not be an issue.

Historically, traditional players like Andreesen Horowitz invest in a company, then the company will build their product to gain as much market momentum and adoption as possible. If the company is successful, they hopefully either go public or sell to another company so the investors can “exit”. The early adopter users who are responsible for the mainstream adoption typically don’t get to taste any financial success associated unless the company goes public, in which case average individuals are relegated to stock market gains, as opposed to massive venture capital gains. There is a reason for this, the average person is not considered an accredited investor. Even if they are comfortable with the risk, the government has decided on their behalf that they cannot participate, it’s too unsafe.

NFTs and other cryptocurrencies are being utilized as a workaround. Much of it is unregulated so many people get scammed over big promises, but there are companies that have success and allow the users to participate in big venture capital type gains (100x gains), typically only reserved for private equity and the like.

The Point

Yuga Labs sourcing their next round of funding from investors like Andreesen is symbolic of a change in mindset.

Instead of sourcing the money from the supporters who backed them from the beginning and are responsible for their adoption, they went back to the original Silicon Valley model and raised the money from the traditional players.

Noone knows what this will mean going forward. Typically big investors like Andreesen hope that their portfolio companies go public or sell so that they can exit and have a windfall, potentially to the detriment of the community that was originally built by fringe crypto enthusiasts and cyberpunks.

Yuga Labs will have to continue to be extremely careful with their community messaging and making sure that they’re not appearing to be sucking value out of their community.

My Thoughts

In my opinion, they’re already failing at this. Yuga Labs plans to sell 200,000 plots of metaverse land by the end of 2022 for 1 Ethereum each. They’re projecting $455 million in net revenue this year. If that’s not cash extraction at its finest, I'm not sure what is.

I believe if Yuga Labs starts veering off track and becomes a traditional cash extracting company, pushing majority of its financial upside to its corporate investors as opposed to NFT holders, whitespace will emerge for a new NFT project to dominate. One that is actually for the people by the people and will practice what it preaches. The market craves it.

Time will tell.

Eric